In November 2025, the overall trend of the Greater Toronto Area (GTA) real estate market remained flat. However, the diverging performance of different housing types—specifically, low-rise home prices continued to face downward pressure while condominium prices demonstrated relative resilience—created a rare window of opportunity for families looking to trade up (sell a smaller home to buy a larger one). As winter takes hold, both sales volume and prices have declined. Nevertheless, this period of low-level market volatility offers growth-oriented buyers practical possibilities for transacting.

📉 Price Stabilization, Sales Volume Retreats

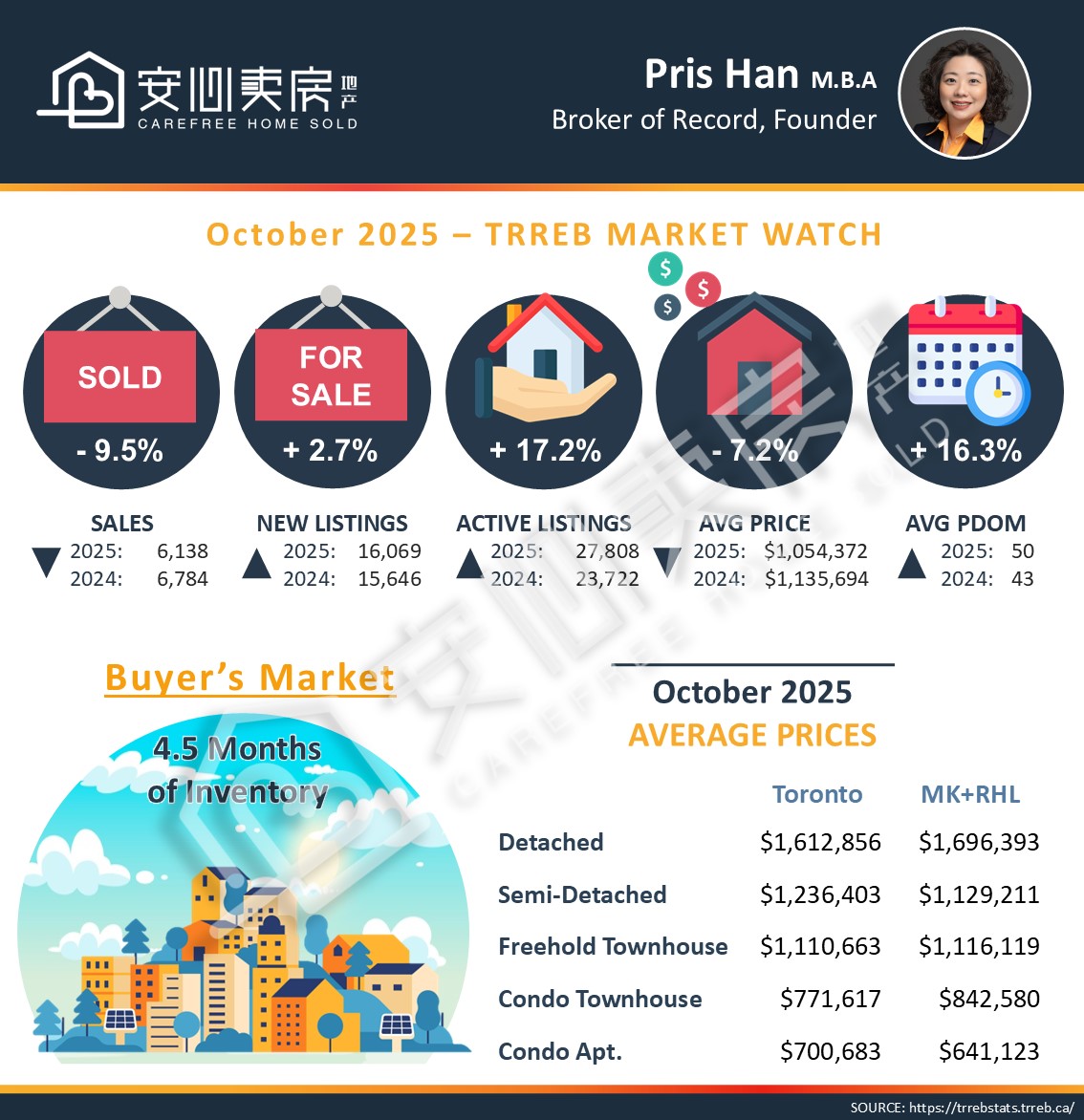

Average Price: $1,039,458, a decrease of approximately $15,000 (-1.4%) MoM from October, returning to the $1.04 million level after two consecutive months of decline; a 6.4% drop compared to $1.11 million YoY.

Sales Volume: Retreating from 6,100 units in October to just over 5,000 units, a decrease of about 18% MoM, marking the lowest level in the past six months; also 16% lower YoY.

Overall, the market has distinctly cooled but still shows price resilience. Buyer hesitation and seller prudence have combined to create this decline in transaction volume.

📦 Supply Shrinks, Inventory Nudges Up

New Listings: 11,134 units, the lowest level of the entire year Active Listings: Decreased to 24,500 units

Months of Inventory (MOI): Rose from 4.5 months in October to 4.9 months, a five-month high

Although new listings hit a low, the decline in sales was even faster, leading to a slight increase in inventory, indicating a subtle recalibration of the market’s supply-demand dynamics.

📅 Average Time on Market Lengthens

ays on Market (DOM): Increased to 56 days, a new high since 2025

This suggests that even with the benchmark interest rate lowered to 2.25%, buyers remain hesitant and sellers are unwilling to drop prices significantly, causing the transaction cycle to continue lengthening. The market is generally cool, yet it remains a rare opportunity for families looking to trade up (sell small, buy big).

💡 Trading Up: Price Gap Narrows to 5-Year Low

Data comparison over the past 5 years shows: Currently, the average price for a detached home is $1.37M and for a condo is $660K, shrinking the price gap to $710,000, which is fully about $300,000 less than the peak period. In early 2022, the average detached home price was $1.82M and the condo price was $810K, where the price gap once exceeded $1 million.

This change reminds home movers:

- Don’t just focus on “How much I can sell my condo for,” but focus more on “How much I need to bridge the gap”

- When the market is hot, although the condo sells high, the detached home rises faster, and the amount needed to bridge the gap could be over a million.

- When the market is cool, the condo may sell for slightly less, but the detached home price has fallen more significantly, easing the pressure to bridge the gap.

- A market with low-level volatility, high inventory, and low competition is the best time to trade up.

📌 Final Opportunity Alert for Growth-Oriented Families

If you miss the current window, once the market heats up, the price difference between your current home and a larger house may widen again, and the opportunity will disappear.

Published on: 2025-12-10

Read More:

GTA Real Estate Market Watch October 2025

GTA Real Estate Market Watch September 2025

GTA Real Estate Market Watch August 2025

Schedule a free consultation and discover your personalized strategy for buying and selling your home!

"*" indicates required fields

Call Carefree Home Sold Realty Pris Han at 647-360-8963 now!

We can help you find ALL properties matching your exact search criteria, including off-market listings, exclusive listings, and even bank foreclosures! Contact us to get started for free.