Pre-Construction Assignment Commission Fee

What is a Pre-Construction Assignment?

In Canada, when buying a pre-construction condo, developers usually allow assignments before closing. An Pre-Construction Assignment means the original buyer sells their purchase agreement to another buyer, who then takes over the contract and completes the final closing with the developer.

The reasons for assignment may include personal or family plan changes (e.g., planning to immigrate to Canada but later giving up). Many times, however, the reason is financial. For example:

- At closing, the buyer must pay the balance (beyond the deposit already paid). Can they secure enough mortgage? If not, can they cover the shortfall with cash? Note: the bank’s loan amount is based on the property’s appraised market value at the time of closing. If Toronto Housing prices fall below the original purchase price, the loan may not be enough.

- If a NRST (Non Resident Sales Tax) applied at the time of purchase, and the buyer still has not obtained Canadian residency, the tax must still be paid in full (based on the rules at purchase, not at closing).

- When interest rates are high, rental income from a Toronto rental property may not cover monthly mortgage payments. Can the buyer cover the difference?

- If it’s for self-residence, can the buyer’s income sustain the mortgage payments?

Depending on the market (supply/demand, interest rates, etc.), assignment sales may bring profit or loss. Therefore, they should be seen more as “insurance” for changing family circumstances. If treated as speculation, losses can be severe if purchase was made at a market high and closing occurs at a low. For instance, many pre-construction condos purchased in downtown Toronto in 2018–2019 and closing in early 2024 have lost over $100,000 just in deposits.

Thus, within one year of the Final Occupancy Day, careful financial planning is needed to decide whether to close or assign.

Note: The Tentative Occupancy Date can be delayed twice. Only the developer’s notified Final Occupancy Date is the true final date.

For financial transactions of assignments, please refer to (https://hanhomesoldrealty.com/en/assignment/#assignment-receiver-fee).

In short, on the assignment closing date, the assignee must pay the assignor both the deposits already paid to the developer and any profit made. If it’s a loss, the assignee pays the deposit minus the loss.

When Can You Assign a Pre-Construction Condo?

A pre-construction condo assignment cannot be transferred immediately after purchase. Developers usually set a specific assignment time window for each project. For example, assignments may only be allowed from the Final Occupancy Day until about three weeks before the Final Closing Day. Once you decide to assign your condo, you must contact the developer’s customer service to confirm the exact start date of this assignment period. Never assume the rules are the same — every builder and every project may have different policies.

Note: The “assignment time window” refers to the time period when the developer accepts assignment applications. The Assignor (original buyer) may find an Assignee (new buyer) before the window officially opens, but the actual transfer can only be submitted once the window is active and requires the developer’s Builder Consent. In most cases, if the original purchase agreement clearly allows assignments and both parties provide complete documents, the developer will not refuse approval.

The best time to list your condo for assignment is usually about six months before the developer’s assignment window opens. If you list too late, you may not have enough time to find a qualified buyer. If you list too early, potential buyers (especially end-users looking for self-residence) may not be motivated to purchase a condo that still has a long wait before closing.

This timing strategy helps maximize exposure, attract serious buyers, and reduce the risk of being stuck without an assignee before closing.

Pre-Construction Assignment vs Resale Condo Sale

Selling a Pre-construction condo assignment is very different from selling a resale condo. Here are the major differences:

1. MLS Listing Restrictions

Most developers do not allow assignments to be listed on MLS. The reason is that many builders still hold some unsold inventory (often called “builder’s inventory” or “final release units”) for later stages. These leftover units are usually priced higher than the initial launch prices. If assignment condos were given the same MLS exposure, their lower prices could directly compete with and hurt the builder’s own sales. To protect their pricing and sell-through, developers often ban MLS listings for assignments.

Without MLS as a unified exposure platform, marketing an assignment condo is much harder compared to selling a resale property. The success of selling an assignment depends heavily on the listing agent’s personal marketing resources—such as strong social media presence, access to a large buyer database, and proven advertising strategies. A regular agent without these tools will struggle to sell an assignment, let alone achieve a good price.

2. Complex Transaction Process

The transaction process for an assignment is much more complicated than a resale condo sale. Both the Assignor (original buyer) and the Assignee (new buyer) must hire lawyers to review the assignment agreement. Many contract terms may require multiple rounds of negotiation before both parties are satisfied. Unlike the straightforward resale purchase agreement, an assignment deal requires significant expertise.

If the listing agent lacks deep experience and doesn’t have a reliable lawyer team, the assignment process can easily break down, sometimes causing the entire deal to collapse. Time is also critical—assignments must close before the developer’s assignment window ends. If the deal isn’t finalized in time, the seller may be forced to take possession. Failing to close on time could result in penalties or even lawsuits from the builder.

3. Tax Implications

An assignment is essentially the sale of a purchase contract, not the property itself. This means 100% of the net assignment profit is treated as income in the year of sale and subject to personal income tax.

For resale condos, only 50% of the capital gains on an investment property are taxable as income (note: after June 2024, if personal income exceeds $250,000, then 66% of the capital gain will be taxable). For a principal residence, however, the capital gain is fully tax-exempt.

Pre-Construction Assignment Decision Service

As your pre-construction condo closing date approaches, original buyers often face a critical decision:

- Assign the condo early – potential for profit, loss, or break-even

- Close on the unit and move in or rent it out

- Walk away and attempt to cancel the agreement with the developer

This decision involves multiple factors: resale condo market trends, tax implications, cash flow, and financing ability. To help you make an informed choice, we offer our【Condo Assignment Decision Service】. This service provides clear market data, cost calculations, and profit/loss evaluations to guide you toward the best option.

🔍 Our Service Includes:

✅ Builder Assignment Policy Review – confirm whether the project allows assignments, assignment window, and deadlines

✅ Resale Market Research – analyze comparable new condo sales in the area to assess market value

✅ Assignment Market Research – review current assignment listings within the same project (since no centralized MLS platform exists, this requires manual screening)

✅ Pricing Strategy – provide professional pricing recommendations and listing strategies based on market data

✅ Rental Estimate – research recent rental transactions of similar units to project rental yield

✅ Financial Profit/Loss Analysis – calculate costs and potential outcomes (requires original purchase agreement and cost details)

📌 Closing Cost & Financial Analysis

- Estimate whether the bank’s appraisal may come in below purchase price (which could trigger a higher down payment)

- Breakdown of all potential closing costs, including Development Levies, Occupancy Fees, Land Transfer Tax, HST, etc.

- Monthly mortgage payment estimates, rental income projection, vacancy risk, and overall cash flow forecast

📌 Assignment Financial Analysis

- Estimate potential assignment selling price based on current market conditions

- Calculate assignment-related fees, commissions, and legal costs

- Estimate capital gains tax exposure on profits

- Calculate overall investment, cash required, and potential return on sale

💰 Service Fee: $399 + HST

If you choose to proceed with us as your listing agent for the assignment, the service fee will be fully credited toward your assignment commission—making this service essentially free.

Our Strength in Pre-Construction Assignment

At Carefree Home Sold Realty, we specialize in pre-construction condo assignments. Why? Because unlike regular agents who lose MLS exposure, we have unmatched marketing influence that ensures your assignment gets maximum visibility.

Through our YouTube channel “Pris Han多伦多安心卖房地产” and our TouTiao channel “Pris Han多伦多安心卖房”, we create professional assignment marketing videos, blogs, and graphics. These are distributed across RED NOTE, Facebook, Instagram and WeChat Channel, reaching over 80,000+ followers in both Canada and China. Combined with algorithm-driven exposure to non-subscribers interested in real estate, our views are consistently strong and far beyond what typical agents can deliver.

Below are a few examples of our presale assignment videos. I ask you, without years of dedicated work in video content creation, can an average agent achieve the same level of exposure?

We have built a database of over 11,000 active buyers waiting for the right property. When our assignment listings are shared through our “Weekly Featured Listings” video newsletter, the chances of finding the right buyer quickly increase dramatically.

We also actively promote assignments in niche platforms where assignment investors and realtors gather—including specialized Facebook groups, WeChat groups, and WhatsApp realtor networks dedicated to condo assignments.

In short, successful assignment marketing requires both creativity and influence: high-quality videos and copywriting that highlight the property’s value, plus a strong distribution network that commands attention from serious buyers. With our dedicated resources and expertise, your Toronto condo assignment can sell quickly—even without MLS exposure and within the short assignment window.

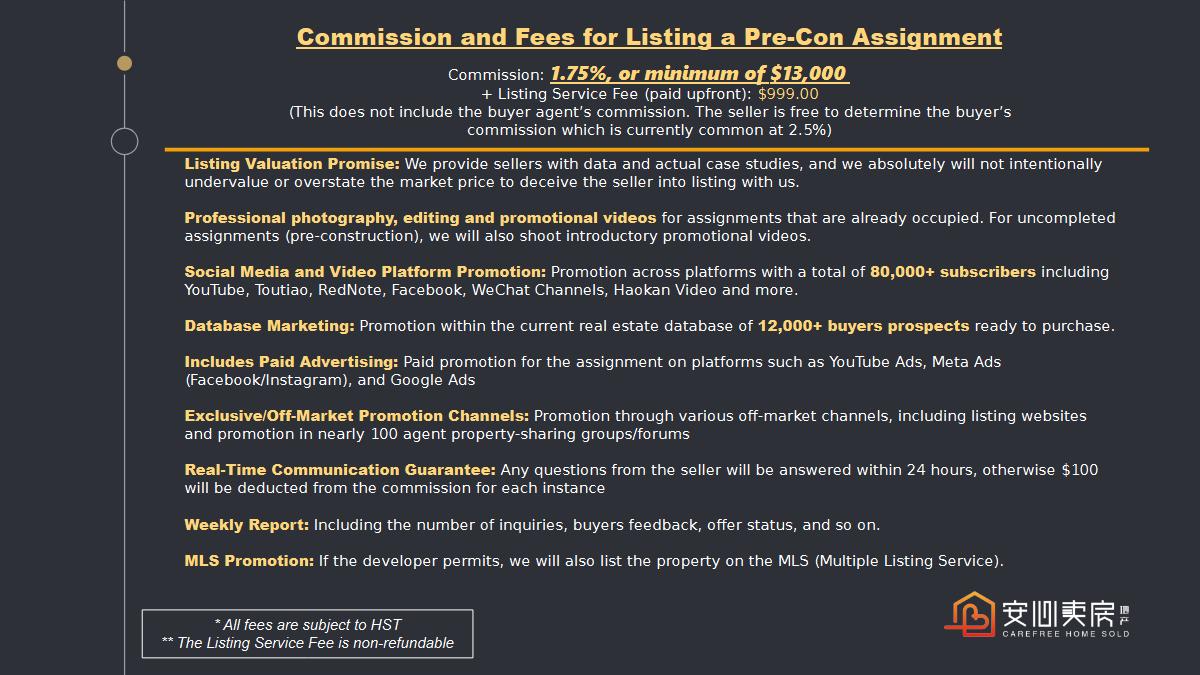

Assignment Sale Commission Fee

In the Greater Toronto Area (GTA), both buyers and sellers typically work with their own real estate agents. The listing agent charges commission directly from the seller, while the buyer’s agent usually also receives commission paid out by the seller.

Although there is no law or industry regulation that requires sellers to pay commission to the buyer’s agent, this remains the standard practice in Toronto real estate transactions. As the seller, you have the flexibility to decide whether to pay the buyer’s agent commission, and if so, how much.

For our assignment sale listing services, our brokerage charges a transparent commission structure designed to be fair and competitive:

Note:

On March 15, 2024, a major lawsuit in the United States against the National Association of Realtors (NAR) was settled with a $400M payout, resulting in sellers no longer being obligated to cover buyer agent commissions. This shift is expected to influence Canadian real estate practices in the coming years.

However, in the Toronto housing market, most listings still include commission for the buyer’s agent. The most common rate today is 2.5% of the sale price paid to the buyer’s agent. Technically, sellers could choose to offer as little as $0.10 CAD, but this may not be practical.

Cutting commission to the buyer’s agent without adjusting the listing price can reduce buyer interest. Buyer agents often compare multiple assignment listings for their clients, and a condo assignment with no commission incentive may be overlooked in favor of more competitive options.

For sellers, it’s important to balance net profit, market exposure, and buyer appeal when setting commission for your assignment sale.

More questions? Contact Us!

Wechat:TeamPrisRealty

Phone:647-360-8963

Email:info@hanhomesold.com

BLOG

Are you ready? The process of buying or selling your home starts here!