In August 2025, the Greater Toronto real estate market showed weakness across all three key indicators—prices, sales volume, and inventory—shifting the market further in favor of buyers.

GTA Real Estate Key Market Highlights

📉Home Prices: Lowest Level in 13 Months

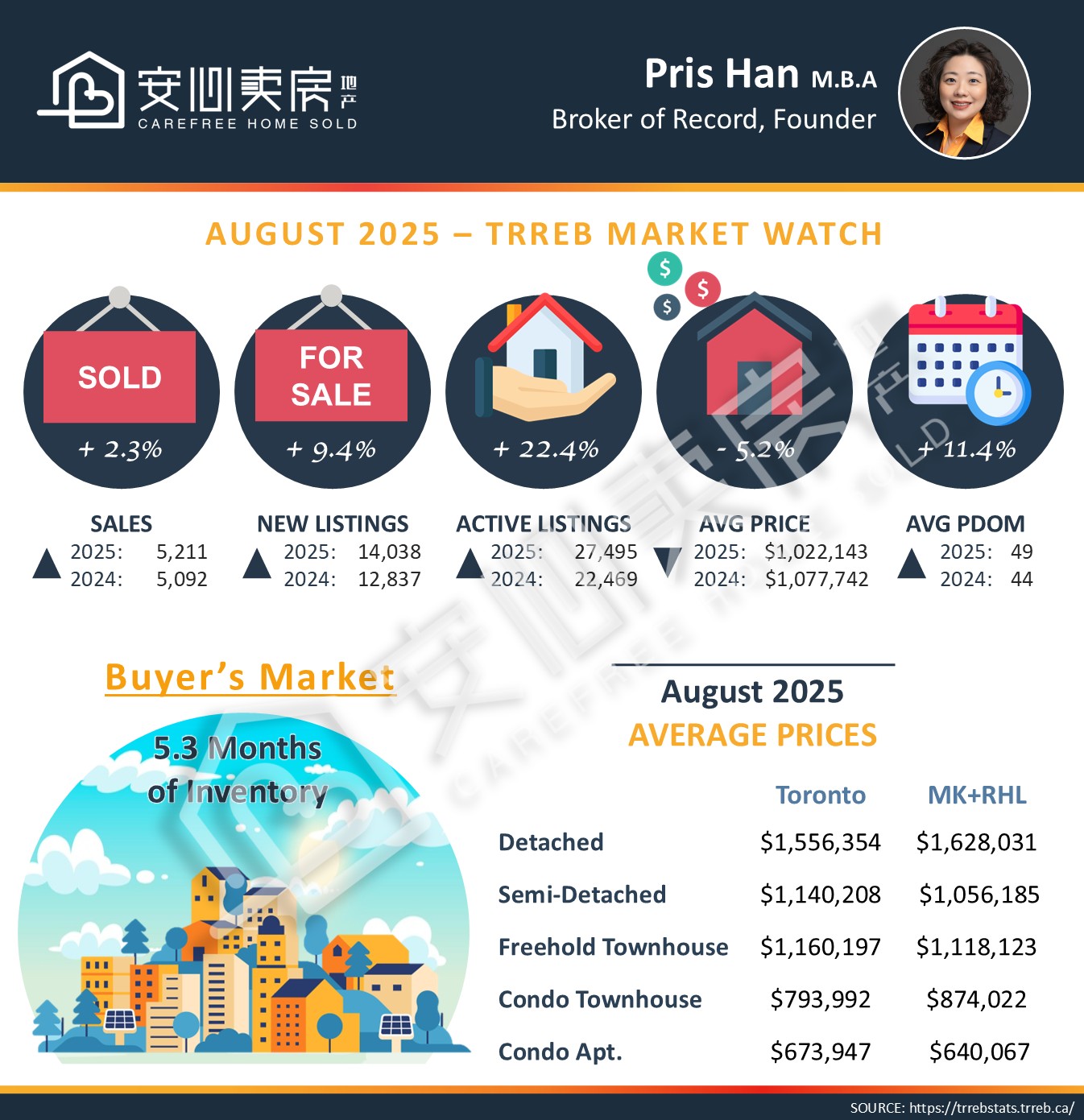

In August, the average home price in the Greater Toronto Area fell to $1,022,143, a drop of nearly $29,500 (-2.8%) from the previous month and 5.2% lower than the same period last year — marking the lowest level in the past 13 months. The decline was especially pronounced in the condo market, where the average price dropped to just $673,947, nearly returning to pre-pandemic levels.

📦 Listings Decline, but Inventory Rises

Although the number of active listings in August fell to 27,495—down from the 30,000+ peak seen in June and July—the sharp drop in sales led to a rise in overall inventory. Only 5,211 homes were sold in August, a 15% decline from the previous month, pushing the months of inventory up to 5.3—the highest level in 2025 so far. This indicates that while sellers are more willing to lower prices, buyers are still holding back, resulting in a slow-moving market.

Active Listings: Longest in Over a Year

The average time on market in August reached 49 days, the longest selling period in the past 13 months. This reflects increased difficulty in closing sales and a growing sense of stagnation in the market.

📈 Seasonal Trend: Late-Summer Declines Shouldn’t Be Overlooked

An analysis of monthly home prices and sales volumes from 2021 to 2025 reveals a consistent seasonal pattern: both prices and sales tend to decline in late summer and early fall each year. Unless there is significant economic stimulus or policy intervention, this appears to be a recurring trend in the Greater Toronto Area market. The market is now entering this seasonal downturn once again.

🔮 Can the Market Rebound Next Spring?

While the housing market typically experiences a seasonal uptick in the spring, the outlook for Spring 2026 remains uncertain. Even in Spring 2025—under what should have been favorable conditions, including multiple interest rate cuts—the market underperformed in March and April. This was largely due to the sudden Canada–U.S. tariff dispute, which significantly shook consumer confidence. Therefore, despite seasonal trends, political and economic disruptions can still override typical market behavior, making it unclear whether a rebound will materialize in the coming spring.

📌 Advice for Sellers: Don’t Wait—Adjust Your Price Early

If you’re a “must-sell” homeowner, now is not the time to gamble on a market rebound. With rising inventory and heightened competition among sellers, failing to proactively adjust your price to stand out among comparable listings may result in your property sitting on the market for an extended period.

💡 Advice for Buyers: Be Strategic—Don’t Wait Until Prices Rise

The current market clearly favors buyers: there are more options, less competition, and a slower pace. This presents an ideal window for end-users to find a home that truly suits their needs. It’s important not to get too fixated on the idea of “buying at the bottom”—because the bottom is usually only identifiable in hindsight. If you wait until the rebound is already underway, you’ll be competing with more buyers, have less room to negotiate, and face more difficulty securing the right property.

Published on: 2025-09-08

Read More:

GTA Real Estate Market Watch July 2025

GTA Real Estate Market Watch June 2025

GTA Real Estate Market Watch May 2025

Schedule a free consultation and discover your personalized strategy for buying and selling your home!

"*" indicates required fields

Call Carefree Home Sold Realty Pris Han at 647-360-8963 now!

We can help you find ALL properties matching your exact search criteria, including off-market listings, exclusive listings, and even bank foreclosures! Contact us to get started for free.